Understanding client needs is crucial in life insurance for delivering tailored solutions and building trust. Effective communication plays a key role, and the AI video roleplay platform is a game-changer here. By simulating realistic interactions, this AI video roleplay platform helps insurance professionals refine their communication skills, engage more effectively, and meet client needs precisely, ultimately driving better outcomes and improving client relationships.

Why is effective communication important in Life Insurance

- Building Trust and Credibility: Effective communication helps establish rapport with clients, making them feel understood and valued. Clear, transparent information about policies fosters confidence and trust.

- Personalizing Client Solutions: Through clear and open discussions, insurance professionals can better understand clients’ specific needs and preferences, leading to tailored insurance solutions.

- Enhancing Client Satisfaction: Effective communication is key to promptly resolving issues and providing ongoing support, which enhances overall client satisfaction and experience.

- Reducing Errors and Misunderstandings: Clear communication minimizes misunderstandings and errors related to policy details and claims, ensuring clients fully understand their coverage and terms.

- Fostering Long-Term Relationships: Positive communication experiences improve client retention and generate referrals, while also enhancing the professional’s reputation for reliability and client focus.

How does Awarathon help

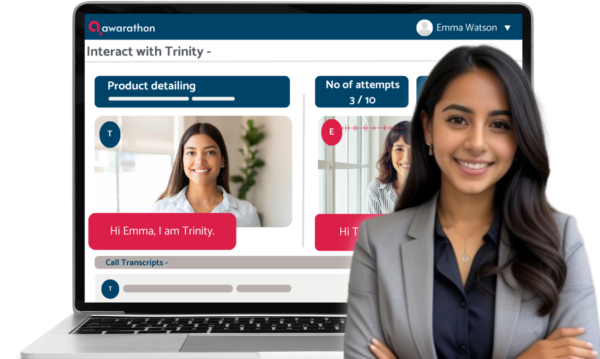

Awarathon’s Trinity is an AI-enabled sales simulator designed to enhance sales training through realistic and interactive scenarios. Here’s how it helps:

-

Real-Life Insurance Simulations

Trinity offers life insurance agents realistic simulations of client interactions, allowing them to practice delivering complex insurance information and handling client concerns effectively. This practical experience prepares agents for real-life client meetings and policy discussions.

-

Custom Scenarios for Different Policy

The platform lets agents customize scenarios to reflect specific life insurance products and client profiles. This ensures that training is directly relevant to the types of policies agents sell and the diverse needs of their clients, enhancing the effectiveness of the practice.

-

Instant Feedback on Performance

Trinity provides immediate, detailed feedback on performance after each simulation. This feedback includes insights into communication techniques and responses, helping agents refine their approach to explaining policy details and addressing client questions. Click here to watch a video on how Trinity gives detailed instant feedback.

-

Probing Techniques for Client Needs

Agents can practice and improve their probing skills with Trinity’s simulations. The platform helps agents learn and gain confidence so that they know how to ask accurate questions to uncover clients’ specific needs and concerns, which is crucial for offering tailored life insurance solutions.

-

Boost Insurance Skills

Trinity aids in developing critical skills such as explaining complex insurance products, managing objections, and building client rapport. Continuous practice in these areas boosts agents’ confidence and proficiency in real-life interactions.

-

Insurance Performance Insights

The platform generates detailed performance reports that analyze communication effectiveness and client engagement strategies. These insights help agents identify areas for improvement. This allows for targeted training to enhance their overall performance and client service.

To summarize this, effective communication is crucial in life insurance for understanding client needs and delivering tailored solutions. Awarathon’s Trinity enhances training by providing realistic simulations, customizable scenarios, and immediate feedback. This advanced AI technology helps agents refine their skills, address client concerns confidently, and build stronger relationships. Utilizing Trinity leads to improved performance and greater client satisfaction in the life insurance industry.

Click here to schedule a demo today.