In the competitive life insurance industry, building strong client relationships is crucial for success. It’s about understanding needs and fostering genuine connections, not just handling transactions. Effective engagement builds trust and loyalty. By using an AI video roleplay platform for insurance, you can enhance client interactions and address their concerns more effectively. Incorporating an AI video roleplay platform for insurance into your practice not only sets you apart from competitors but also contributes to a more rewarding and successful career.

Key Strategies for Life Insurance Advisors in Client Engagement

-

Personalize Policy Recommendations:

Customize insurance solutions based on individual client profiles. It includes their financial goals, family situation, and risk tolerance. Personalized recommendations show clients that you understand their unique needs.

-

Understand Policy Details Thoroughly:

Be well-versed in the nuances of different insurance products and policies. This allows you to answer questions accurately and provide detailed explanations that help clients make informed decisions.

-

Build Trust Through Clear Communication:

Clearly explain policy terms, coverage options, and any potential exclusions. Transparent communication helps establish trust and reduces the risk of misunderstandings or dissatisfaction.

-

Conduct Regular Policy Reviews:

Schedule periodic reviews of clients’ insurance policies to ensure they still meet their needs as life circumstances change. This proactive approach demonstrates your commitment to their long-term financial well-being.

-

Foster Long-Term Relationships:

Focus on building lasting relationships by staying in touch with clients beyond policy sales. This includes reaching out during important life events and offering ongoing support.

Here’s How Awarathon’s AI Role Play Platform Improves Life Insurance Advisors’ Client Engagement

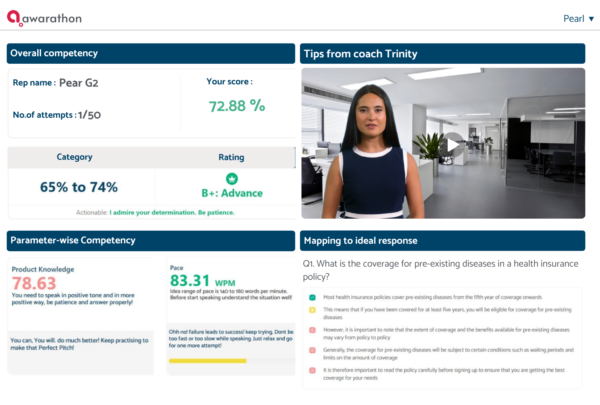

Awarathon is an AI-powered role play platform-Trinity is designed to enhance the skills of life insurance advisors by simulating real-life client interactions. This innovative platform allows advisors to practice and perfect their client engagement strategies in a controlled environment. It provides valuable insights and instant feedback to improve their performance.

-

Simulate Real-Life Client Scenarios:

Trinity allows advisors to practice and refine their responses to a variety of client scenarios. It customizes questions about policy coverage, claims processes, and financial planning based on client scenarios. This prepares advisors to handle real client interactions more effectively.

-

Enhance Communication Skills:

Trinity helps advisors improve their communication techniques by providing feedback on their verbal and non-verbal cues. They can also give multiple assessment attempts and watch the recording. This can lead to clearer explanations of complex insurance products and more persuasive client interactions.

-

Practice Handling Objections:

Advisors can use Trinity to practice addressing objections and concerns that clients might have about life insurance policies. Trinity generates relevant objections based on different situations. This helps in developing strategies to overcome objections and reassure clients.

-

Personalize Client Interactions:

By simulating different client profiles and needs, advisors can practice tailoring their approach to fit various client situations. This customization improves the relevance of their recommendations and enhances client satisfaction.

-

Build Confidence:

Regular practice with the AI role play platform helps advisors build confidence in their client interactions. Increased confidence leads to more effective communication and stronger client relationships.

-

Receive Instant Feedback:

Awarathon offers instant feedback on performance. This feedback highlights areas for improvement and suggests strategies to enhance client interactions. This continuous learning process contributes to better client engagement.

Conclusion

Excelling in life insurance depends on building strong client relationships through tailored recommendations, transparent communication, and regular policy reviews. Awarathon’s AI roleplay platform takes this further by providing realistic practice scenarios. It also provides instant valuable feedback and enhances your client interactions. This improves your ability to connect with clients and sets you apart from competitors leading to a more successful and fulfilling career. Check out our product videos here.

Click here to schedule a demo with Awarathon today.