In today’s fast-paced insurance industry, staying ahead requires more than just traditional sales tactics. AI coaching for insurance agents is transforming the way agents improve their skills, manage time effectively, and close more deals. With AI coaching for insurance agents, professionals can refine their approach, enhance customer interactions, and stay competitive in an evolving landscape. However, insurance agents still face several challenges that hinder their productivity. Let’s explore the common challenges first before diving into the AI-driven strategies that can help overcome them.

5 Key Challenges Faced by Insurance Agents

- Intense Competition in the Market – The insurance industry is highly competitive, with multiple agents vying for the same prospects. Standing out and differentiating services can be a major challenge, requiring agents to consistently refine their sales techniques and client engagement strategies.

- Complex Product Knowledge – Insurance policies involve intricate details, as a result, it makes it difficult for agents to retain all necessary information and confidently answer client queries on the spot.

- Difficulty in Maintaining Customer Relationships – Agents often struggle to stay in touch with existing clients, leading to missed renewal opportunities and lower customer retention rates.

- Building Customer Trust – Establishing credibility and trust with clients is a long process, as many prospects hesitate to invest in insurance due to skepticism and lack of understanding.

- Handling Objections Effectively – Agents often struggle with countering objections related to pricing, policy terms, or competitors, leading to lost sales opportunities.

5 AI-Driven Strategies with Awarathon to Enhance Productivity

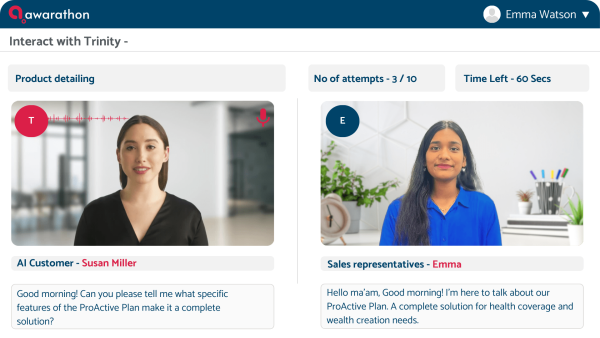

Awarathon is an AI-powered sales coaching platform that helps insurance agents refine their skills through AI-driven video roleplays and real-time analytics. With instant feedback and personalized coaching, Awarathon enables agents to perfect their pitch, improve customer engagement, and close more deals.

Watch how our AI coach enhances the productivity of insurance agents

Customizable Roleplay Scenarios

Awarathon’s AI video roleplay platform allows agents to simulate real-life client interactions, helping them practice responses to tough questions, objections, and negotiations. Since these simulations are tailored to replicate real-world scenarios, the agents ensure that their training is relevant and practical. By engaging in AI-driven roleplays, agents can refine their pitch, enhance persuasion skills, and become more adaptable to various client behaviors.

Instant Feedback for Continuous Improvement

With AI-driven insights, insurance agents receive real-time feedback on their pitch, tone, and clarity, enabling them to refine their approach immediately. This instant feedback mechanism helps agents identify areas of improvement quickly and apply corrections right away. Over time, this iterative process enhances their confidence and overall sales performance, ensuring they are well-prepared for client interactions.

Probing Techniques for Effective Communication

Awarathon’s AI-guided coaching helps agents master probing techniques, allowing them to ask precise questions and uncover customer needs efficiently. Effective probing ensures that agents fully understand a client’s financial situation, concerns, and preferences, making it easier to tailor insurance solutions that best fit their needs. This approach not only improves client satisfaction but also boosts the likelihood of successful policy conversions.

Confidence Building Through Repetitive Practice

By repeatedly engaging in AI-driven roleplays, agents can enhance their confidence because it helps them to be more persuasive and effective in real-world sales scenarios. Besides, the ability to practice different sales situations repeatedly allows agents to develop muscle memory for handling various objections and questions. This repetitive exposure reduces hesitation and enhances their ability to close deals efficiently, even in high-pressure situations.

Data-Driven Performance Analytics

Awarathon provides detailed reports on an agent’s strengths and areas for improvement. Moreover, it ensures personalized training that maximizes productivity and sales performance. These reports analyze verbal and non-verbal cues, speech patterns, and overall engagement levels, offering deep insights into an agent’s sales proficiency. The data-driven approach allows managers to identify trends, customize training programs, and track progress over time, ultimately leading to a more effective sales force.

By addressing common challenges with these AI-driven strategies, insurance agents can enhance their skills, close more deals, and boost overall productivity. Awarathon’s innovative AI coaching platform is paving the way for the future of sales training in the insurance industry.

Click here to schedule a meeting today!