In the fast-evolving insurance industry, clarity in policy explanations can make all the difference in securing a client’s trust and closing deals. Conversational AI for Insurance Agents is transforming sales training by enabling agents to communicate policies effectively, address customer concerns confidently, and build stronger relationships. With Conversational AI for Insurance Agents, companies can equip their teams with realistic, AI-driven roleplays to refine their approach and master the art of persuasion.

5 Key Benefits of AI Sales Training for Insurance Agents

- Enhanced Communication Skills – AI-driven training enables agents to practice policy explanations, refine their speech, and improve their tone to make complex insurance terms more digestible.

- Handling Objections With Confidence – Insurance clients often have concerns about coverage, pricing, and claim processes. AI simulations help agents practice responses to common objections in a safe environment.

- Personalized Customer Interactions – AI roleplay adapts to different customer personas, training agents to tailor their pitch based on individual needs and risk factors.

- Compliance and Regulation Training – Insurance agents must stay updated with changing policies and legal requirements. AI training modules reinforce compliance by simulating real-world scenarios.

- Performance Analytics and Feedback – AI-powered training provides instant feedback on verbal and non-verbal cues, helping agents refine their delivery and boost engagement.

Awarathon AI Roleplay Platform: Transforming Insurance Sales Training

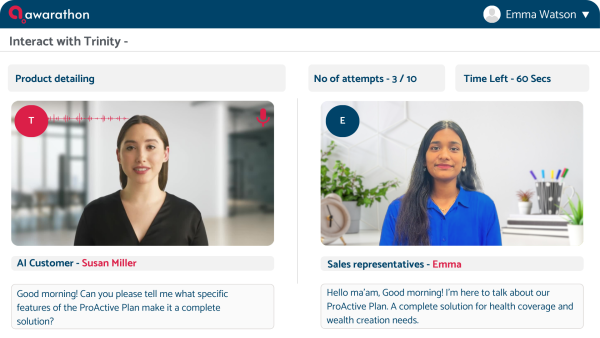

Awarathon is an AI-driven sales coaching platform designed to enhance communication and persuasion skills through interactive roleplays. It helps insurance agents improve policy explanations, handle objections, and enhance customer interactions.

Watch how our AI Coach helps to product knowledge

-

Building Confidence in Policy Explanations

Awarathon’s AI-driven roleplay allows insurance agents to repeatedly practice explaining policies until they achieve clarity and fluency. By engaging in AI-led interactions, agents refine their ability to break down complex policy details into simple, digestible information. This ensures that customers fully understand their coverage options, making them more likely to make informed purchasing decisions.

-

Strengthening Objection Handling

Handling objections is critical in insurance sales, where prospects often hesitate due to cost concerns or policy exclusions. Awarathon’s AI generates customer scenarios that challenge agents to respond effectively to tough questions. Through guided feedback, agents learn to navigate objections with persuasive explanations, ensuring they address client concerns while keeping the conversation focused on value.

-

Personalized Pitches for Different Customer Personas

Insurance customers have diverse needs based on age, lifestyle, and risk factors. Awarathon’s AI-driven training creates adaptive sales scenarios where agents practice tailoring their approach to different customer profiles. Whether selling a life insurance policy to a young professional or a retirement plan to a senior citizen, agents gain the skills to personalize their pitch and establish trust quickly.

-

Ensuring Regulatory Compliance

Compliance is a major challenge in the insurance sector, where agents must adhere to strict regulations while explaining policies. Awarathon integrates compliance training within its roleplays, ensuring that agents practice ethical selling and avoid misleading statements. By simulating policy disclosures and consent-based selling, the platform prepares agents to meet industry standards with confidence.

-

Providing Data-Driven Performance Insights

Awarathon’s AI tracks verbal fluency, engagement levels, and objection-handling effectiveness, offering detailed performance reports. These insights allow insurance companies to identify knowledge gaps and refine training strategies. By leveraging AI-driven analytics, organizations can ensure that their sales teams consistently improve, leading to higher conversion rates and better customer satisfaction.

By incorporating Awarathon’s AI sales coaching, insurance companies can elevate their training programs. This also enables agents to communicate policies with clarity, handle objections with ease, and build lasting customer relationships. As the insurance industry continues to evolve, AI-driven training is the key to staying ahead in a competitive market.

Click here to schedule a demo today!