In the competitive insurance sector, strong pitching skills are essential for building trust, simplifying complex policies, and addressing client concerns effectively. According to Minksey, AI is reshaping customer interactions by enhancing personalization and improving engagement. These skills often determine whether an agent can turn prospects into loyal customers. Conversational AI for insurance agents offers a cutting-edge solution by providing platforms for agents to practice and perfect their pitches. With conversational AI for insurance agents, agents can refine their communication strategies through interactive roleplay scenarios and real-time feedback, making their pitches more persuasive and client-focused.

Key Benefits of Conversational AI for Insurance Agents

Personalized Practice: Conversational AI creates tailored roleplay scenarios based on an agent’s specific challenges, such as handling objections or explaining complex policies. This targeted approach ensures agents focus on areas needing improvement, resulting in more effective and confident pitches.

Improved Client Understanding: Agents can tailor their pitches to be more relevant and personalized by analyzing client needs, preferences, and concerns. This ability to adjust ensures agents communicate effectively with each client. Ultimately, it helps build stronger, more trusting client relationships.

Scalable Training: AI enables agents to practice their pitching skills anytime and anywhere, without the constraints of traditional training schedules. This flexibility removes barriers to learning, allowing agents to continuously improve at their own pace.

Consistent Performance: Conversational AI enables agents to practice their pitch repeatedly until they perfect it. This continuous practice ensures agents consistently deliver high-quality, effective pitches in every interaction. It helps them refine their approach until it becomes second nature.

How Awarathon Helps Insurance Agents Improve Their Pitching Skills with AI

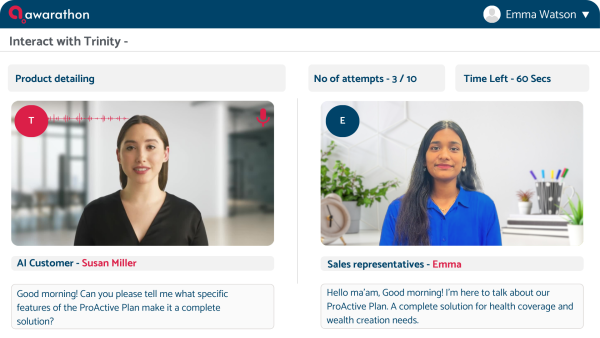

Awarathon is an AI-based sales role-play platform that helps insurance agents improve their pitching skills. Through interactive scenarios and real-time feedback, agents can refine their communication strategies. By simulating real client interactions, Awarathon ensures more effective and personalized pitches. This conversational AI for insurance agents enhances performance and drives success.

Watch how our AI coach interacts with Insurance Agents to improve their pitching skills

Product Knowledge

In the insurance sector, policies are tailored to meet the diverse needs of different customers. Agents must have a deep understanding of each policy to effectively answer client queries. With the AI roleplay platform, agents can practice responding to various product-related questions in realistic scenarios. It allowes them to enhance their product knowledge and improve their ability to address client concerns confidently and accurately

Confidence and Communication Skills:

In the insurance sector, not every customer will make an agent feel comfortable, so starting the conversation with confidence is essential. Practicing AI-based roleplay platforms like Awarathon allows agents to build confidence and refine their communication skills, preparing them to handle any client interaction effectively.

Objection Handling and Probing Skills:

With many insurance companies offering similar policies, agents must know how to handle objections such as questions about high prices or similar features. AI roleplay platforms like Awarathon help agents practice probing techniques and objection-handling strategies, enabling them to respond effectively and keep clients engaged in the conversation.

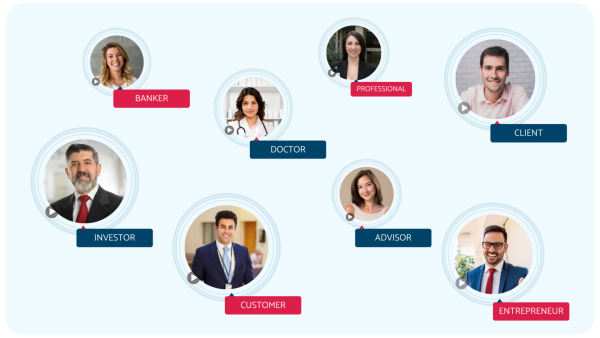

AI Persona

Awarathon’s platform features AI personas with varying emotions, such as anger, distraction, and calm, allowing agents to practice handling diverse customer reactions. This helps agents develop the skills to manage challenging situations, refine their pitching techniques, and effectively adapt their approach to each customer’s emotional state.

Detailed Reports:

Awarathon provides instant, detailed reports that evaluate key parameters like opening and closing statements, facial expressions, and tone. These reports offer a comprehensive analysis of an agent’s performance, highlighting strengths and areas for improvement. Insurance agents can fine-tune their approach and enhance their pitching skills by reviewing these insights.

Mastering pitching skills is crucial in the competitive insurance industry. Awarathon’s AI platform helps agents refine their communication, product knowledge, and objection-handling abilities through personalized roleplay and real-time feedback. This continuous improvement ensures agents deliver effective, client-focused pitches, driving sales success.

Click here to schedule a demo today with Awarathon.