Traditional training often leaves insurance agents unprepared for real objections and unaware of real-time compliance risks. That’s where sales coaching in insurance needs a shift—from static modules to smarter, scenario-based learning. AI video roleplay is transforming the way agents learn, offering a realistic practice that builds trust, sharpens advice delivery, and ensures regulatory alignment. Platforms like Awarathon are leading this evolution in sales coaching in insurance, with intelligent, adaptive, and compliance-first training.

Challenges in Traditional Insurance Training

- Scripted Conversations:

Insurance agents often follow memorized scripts that sound unnatural and fail to connect with today’s informed customers. - Compliance Is an Afterthought:

Agents are taught compliance rules after training, not during it, which leads to missed disclosures and regulatory risks in real conversations. - Training Ignores Market Differences:

Agents across regions get the same content, even though customer needs vary by location, lifestyle, and financial goals. - Repetitive Responses:

Traditional training can’t adapt when a conversation takes a turn—leaving agents unprepared for real-life objections or questions. - No Timely Feedback:

Without live insights or coaching, managers spot performance gaps only after lost sales or failed audits.

How Awarathon’s- AI Coaching Platforms Help Insurance Agents

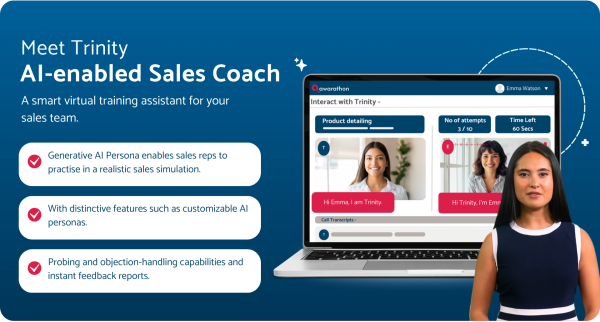

Awarathon is an AI-driven sales coaching platform that uses a virtual AI Coach to simulate real-life customer interactions. It enables frontline sales reps to practice product detailing, objection handling, and probing through realistic, scenario-based video roleplays. With instant feedback and personalized insights, Awarathon helps teams build confidence, improve performance, and close more deals.

Meet our AI Coach- Trinity

Click here to watch how our AI coach trains your agents to handle objections

-

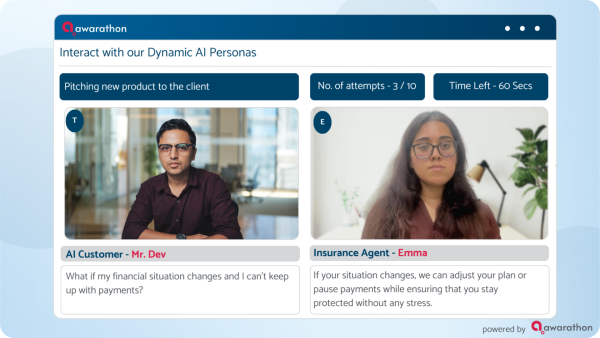

Roleplays with Realistic Client Persona

Awarathon’s AI Coach doesn’t rely on generic, one-size-fits-all scripts. It functions like a live client, presenting insurance agents with diverse, lifelike customer personas—each with its own financial priorities, goals, and risk perceptions. From cautious buyers concerned about premiums to seasoned investors focused on returns, agents are trained to adapt their messaging and approach in real-time. This strengthens their ability to personalize conversations and respond naturally to any buyer type.

-

Builds Compliance Habits with Instant Feedback

In insurance, compliance isn’t optional—it’s critical. Awarathon’s AI Coach acts like a vigilant trainer, listening to every agent’s pitch and immediately flagging any compliance errors during the conversation. Whether it’s a missing disclaimer, an exaggerated claim, or a regulatory red flag, agents receive real-time prompts to self-correct. This proactive feedback loop ensures they internalize compliant behavior, not just memorize rules for later.

-

Guides Through Dynamic Scenarios

Unlike static training tools, Awarathon’s AI Coach adjusts the roleplay flow based on agent performance. If an agent gives a vague explanation, the scenario becomes tougher, introducing more resistance or questions. A well-handled pitch leads to positive progression. This branching approach mirrors real customer journeys and teaches agents to think critically, navigate objections, and manage conversations under pressure—just like an experienced sales trainer would.

-

Tracks Individual Progress for Targeted Coaching

Every agent has unique strengths and learning needs. Awarathon’s AI Coach tracks performance across scenarios, highlighting specific improvement areas for each individual. Managers receive actionable insights, enabling targeted interventions instead of one-size-fits-all re-training. This ensures every agent grows faster and stays aligned with sales and compliance goals.

-

Prepares Agents for Tough Customer Objections

Objection handling is a critical skill in insurance sales, and Awarathon’s AI Coach helps agents master it through repeated exposure to tough, real-world scenarios. From premium concerns to policy comparisons, the AI presents common and complex objections, guiding agents to respond with confidence, accuracy, and empathy—ultimately improving their ability to close difficult deals.

Traditional training no longer meets the demands of modern insurance sales. Agents need to personalize conversations, handle objections, and stay compliant—all in real time. Awarathon’s AI Coach makes this possible through realistic roleplays, instant feedback, and adaptive learning. As sales coaching in insurance evolves, Awarathon empowers agents to sell smarter and stay aligned with customer and compliance needs.

Click here to schedule a demo today!