In the competitive world of insurance sales, overcoming objections is a critical skill that determines success. Agents frequently encounter concerns related to pricing, policy coverage, claim processes, and trust. Traditional training methods often fail to prepare agents for the dynamic and unpredictable nature of real-world objections. This is where AI-powered roleplay solutions like Awarathon come in. By simulating real-life customer interactions, AI-driven sales coaching enables insurance agents to refine their objection-handling techniques in a controlled environment.

Common Objections Faced by Insurance Agents

- “The premium is too high.”– Customers hesitate due to perceived high costs. Agents must highlight benefits like long-term security, tax savings, and flexible payment options to justify the premium.

- “I already have insurance.”– Customers may feel their existing policy is sufficient. Agents should identify coverage gaps and explain additional benefits such as critical illness coverage or better returns.

- “I don’t trust insurance companies.”– Mistrust stems from past experiences or misinformation. Agents should build credibility by showcasing claim settlement ratios, customer testimonials, and regulatory compliance.

- “I don’t think I need insurance.”– Younger individuals or financially secure customers may overlook insurance. Agents need to educate them on unforeseen risks like medical emergencies or income loss.

- “The claim process is too complicated.”– Many worry about filing claims. Agents should explain the simplified process, assist with documentation, and highlight digital claim options.

How Awarathon Helps Insurance Agents Overcome Objections

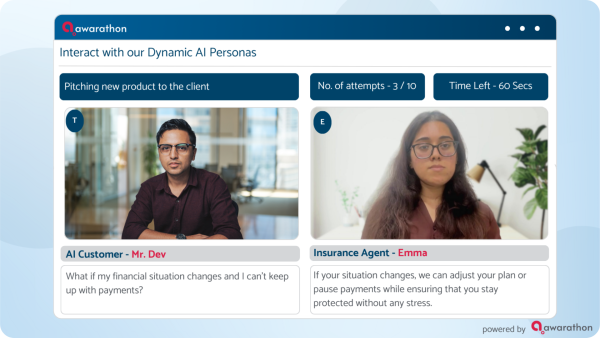

Awarathon is an AI-powered sales readiness platform that enhances insurance agents’ objection-handling skills through AI-driven roleplay and real-time feedback.

Watch how our AI coach asks tough objections to insurance agents

-

AI-Powered Objection Handling Simulations

Awarathon replicates real customer objections, allowing agents to practice responses in realistic, interactive roleplays. These simulations cover various objection scenarios, ensuring that agents develop confidence and fluency in their responses. By repeatedly facing difficult customer interactions, agents become more prepared for real-world conversations.

-

Instant Feedback for Better Responses

Agents receive AI-generated feedback on clarity, confidence, and persuasiveness, ensuring they refine their approach for real interactions. This immediate evaluation allows them to adjust their tone, pitch, and messaging in real time, leading to stronger, more convincing responses.

-

Personalized Training for Different Customers

The platform adapts scenarios based on different customer personas, helping agents craft tailored responses. Agents can practice handling objections from young professionals, retirees, or high-net-worth individuals, ensuring their sales approach aligns with the customer’s mindset and concerns.

-

Scenario-Based Learning for Complex Discussions

Agents learn how to navigate detailed policy explanations and counter objections with facts and clarity. Awarathon provides structured modules that help agents explain technical details, such as policy exclusions, premium structures, and claim settlement ratios, simply and persuasively.

-

Performance Tracking for Continuous Improvement

Awarathon’s analytics help managers identify skill gaps and provide targeted coaching to enhance agent performance. Agents can review their past interactions, measure improvements, and focus on areas where they need the most training. This continuous learning cycle ensures that agents are always refining their objection-handling techniques.

See how India’s number 1 insurance company, leveraged Awarathon to improve their revenue generation by 10% in 4 months- Click here to read the full case study.

Mastering objection handling is essential for insurance agents to close deals and build trust. Awarathon’s AI-driven training ensures agents can confidently address concerns and improve sales outcomes. By practicing in a risk-free environment, agents become more persuasive and successful in overcoming customer objections.

Click here to schedule a demo today.